Holistic Realty Financial Investment Method Development and Administration Solutions

In the realm of real estate financial investment, the mission for a detailed strategy that includes all aspects of advancement and monitoring is a continuous trip. In this conversation, we will certainly discover just how a cohesive blend of market analysis, threat evaluation, lasting practices, ESG concepts, and technical improvements can merge to form a durable foundation for efficient genuine estate financial investment strategies.

Market Analysis for Financial Investment Opportunities

Carrying out a complete market analysis is essential for determining profitable investment possibilities in realty. By analyzing market patterns, demand-supply dynamics, financial indications, and demographic factors, capitalists can make educated choices and alleviate dangers. Market analysis aids capitalists understand the present state of the property market, projection future fads, and identify possible locations for growth and profitability.

One essential element of market analysis is identifying arising markets or neighborhoods with high growth capacity. These areas may show enhancing property values, rising need from purchasers or renters, and facilities advancements that can positively influence property rates - real estate buyback. By focusing on these development locations, capitalists can profit from the gratitude of building worths and generate eye-catching returns on their financial investments

Furthermore, market evaluation allows investors to examine the competitive landscape and pricing approaches of various other market gamers. Recognizing the competition can aid capitalists place their financial investments effectively, separate their offerings, and enhance their investment returns. In general, a thorough market evaluation creates the foundation for a successful realty investment technique.

Danger Evaluation and Reduction Approaches

Efficient realty investment strategies require a careful analysis of possible threats and the implementation of robust reduction measures. Threat evaluation is a crucial component of genuine estate investment as it enables capitalists to identify and evaluate unpredictabilities that can impact their investments. Usual threats in realty consist of market volatility, changes in rates of interest, home depreciation, and unexpected costs. To successfully minimize these threats, investors can use numerous approaches such as diversity, comprehensive due persistance, insurance protection, and maintaining a monetary barrier for unforeseen situations.

Sustainable Home Management Techniques

Executing lasting home management techniques is crucial for enhancing the long-term environmental and financial efficiency of realty financial investments. By integrating sustainability practices right into property administration approaches, investor can minimize functional expenses, enhance possession worth, and attract environmentally mindful tenants. One vital element of lasting home management is energy performance. Implementing energy-efficient innovations and practices, such as LED lights, smart thermostats, and energy-efficient get more devices, can considerably reduce power intake and operating expenditures. Furthermore, water preservation procedures, such as low-flow fixtures and drought-resistant landscaping, can aid decrease water use and prices.

Moreover, incorporating sustainable structure materials and techniques during building and construction and remodelling projects can boost indoor air quality, lower waste, and reduced upkeep expenditures with time (real estate buyback). Sustainable residential property administration also includes waste management methods, such as reusing programs and waste decrease campaigns, to reduce ecological influence and promote a healthier living atmosphere for owners. Overall, integrating lasting home administration strategies not only profits the setting yet additionally enhances the long-lasting productivity and resilience why not find out more of property financial investments

Integrating ESG Principles in Investments

To improve the sustainability and honest impact of property financial investments, integrating Environmental, Social, and Governance (ESG) concepts has actually ended up being a crucial focus for conscientious investors. ESG aspects play an essential duty in shaping investment choices, aiming to produce long-term worth while considering the broader effect on society and the environment.

Innovation Combination for Efficient Procedures

Integration of sophisticated technical services is necessary for optimizing operational efficiency in actual estate investments. In today's busy digital landscape, actual estate investors and residential or commercial property supervisors are significantly turning to innovation to simplify procedures, improve renter experiences, and drive earnings. One crucial element of innovation combination is making use of clever structure systems. These systems take advantage of IoT (Web of Things) technology to automate processes such as home heating, ventilation, air conditioning, protection, and lights, inevitably decreasing energy intake and functional prices.

Moreover, data analytics and AI (Synthetic Knowledge) tools are being made use of to collect and assess vast amounts of information to make enlightened investment decisions and forecast market trends precisely. This data-driven method enables investors to determine possibilities, reduce dangers, and maximize profile performance. Additionally, cloud-based building management systems are changing just how realty properties are handled, giving central access to vital information, boosting communication, and fostering cooperation among stakeholders.

Conclusion

In verdict, the alternative approach to realty financial investment strategy growth and Resources management uses a comprehensive structure for success. By conducting comprehensive market analysis, carrying out risk mitigation approaches, utilizing sustainable home management methods, including ESG concepts, and integrating innovation for reliable operations, investors can maximize their returns and produce lasting worth. This approach guarantees a well-rounded and sustainable investment method that takes into consideration all elements of the realty market.

In this discussion, we will check out exactly how a natural blend of market analysis, danger evaluation, lasting methods, ESG concepts, and technological improvements can assemble to create a durable structure for efficient genuine estate investment methods.

Understanding the competition can aid financiers position their investments effectively, separate their offerings, and enhance their investment returns - real estate buyback. Risk analysis is a critical part of real estate financial investment as it permits investors to recognize and review unpredictabilities that could influence their investments.Implementing lasting property administration methods is important for enhancing the long-term ecological and monetary performance of actual estate financial investments. In general, integrating lasting property administration techniques not only benefits the setting yet also enhances the long-term productivity and durability of actual estate investments

Jake Lloyd Then & Now!

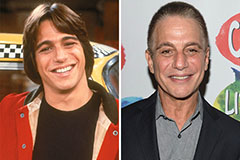

Jake Lloyd Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!